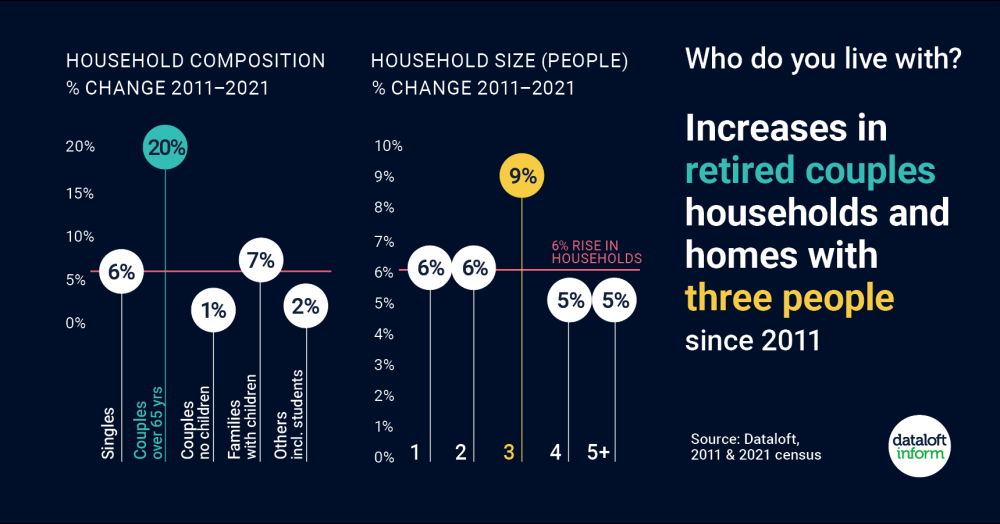

Since 2011, there has been a 6% rise in households and a noticeable change in their composition and size in England and Wales.

- There are now 20% more households where couples are above the retirement age. This change has driven demand for more property variety in the market, particularly purpose-built retirement homes, which are able to command premiums of 32% in popular places such as Cornwall.

- There has been a decline in the proportion of households made up of child-free couples, with only a 1% increase. The number of family households with children has increased by 7%, pointing to a demand for homes with two or more bedrooms. Households with three people have grown the most (+9%). Source: Dataloft, Census 2011 & 2021