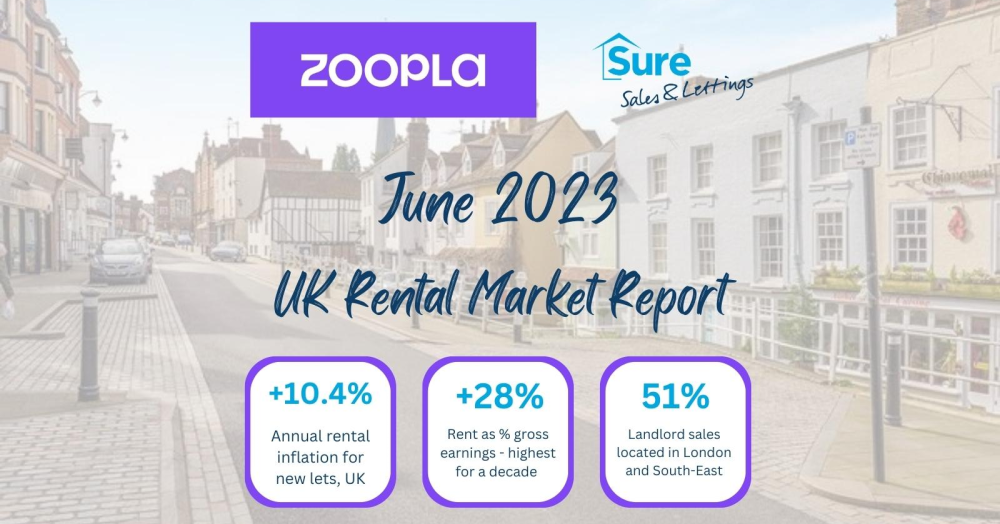

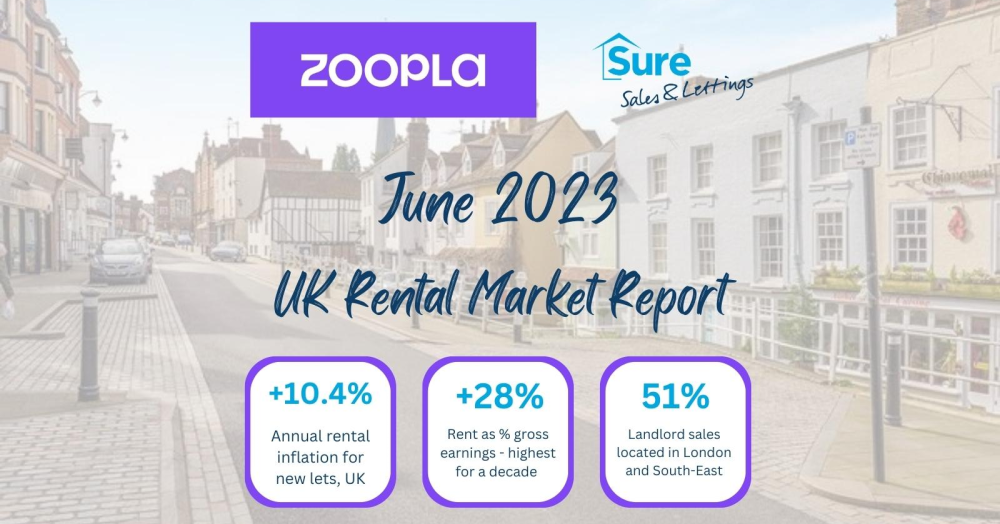

+10.4% Annual rental inflation for new lets, UK

+28% Rent as % gross earnings – highest for a decade

51% Landlord sales located in London and South-East Executive summary

•Rental inflation running in double digits for 15thconsecutive month

•No let up in supply/demand imbalance as we enter busier summer period when demand typically increases by up to 40%

•Rents have grown faster than average earnings over last 21 months

•Rental costs as a proportion of earnings reach highest for a decade

•Emerging evidence of growing stress for renters on lower incomes

•Weakness in the sales market likely to support rental supply in H2

•Higher mortgage rates hit 20-30% of landlords with largest loans

•Landlord sales are concentrated in London and the South East where yields are lowest and extra equity required at refinancing

Rental inflation continues to run in double digits

Rents continue to register double digit growth for the 15th month in a row.

Seasonal factors contributed to the annual rate of inflation slowing to 10.4% from a recent high of 12% in August 2022.

An ongoing chronic imbalance between supply and demand continues to push rents higher across all parts of the UK. This is set to continue into H2 2023 as we approach the usual seasonal upturn in demand over the summer and into the autumn.

With little prospect of increased supply, the growing unaffordability of renting will start to act as a drag on rental inflation. We expect rental growth to slow towards 8% by the year end, still above earnings growth. The impact of higher rents is not uniform with those on low incomes bearing the brunt, with increasing signs of stress.

Rental (un)affordability reaches a decade high

Rents track earnings over the long run. However, the UK rents have been growing faster than earnings for the last 21 months, since October 2021. This has pushed the proportion of gross earnings spent on rent to its highest level for a decade. Average UK rents account for 28.3% of average pre-tax earnings1 versus a 10-year average of 27%.

Rental affordability is currently at its worst for a decade in seven of the 12 regions of the UK. In another four, earnings spent on rent are within 2% of the last decades' high. While renting in London is the most expensive of all regions (averaging 40% of gross earnings), it is still below the peak of 43% reached in September 2015.

The longer rents rise faster than earnings, the greater the affordability pressures on renters. It will ultimately start to impact demand and the pace of rental growth.

Entrenched supply/demand mismatch pushing up rents

Rental inflation will only slow if we were to see a material increase in supply or weaker demand. The latter seems unlikely given rising mortgage rates impacting first time buyers, the strength of the labour market, high immigration and upcoming busiest period for rental demand –between July and September.

The level of homes for rent remains stuck 20-40% below prepandemic levels in most regions. This means more renters chasing fewer homes, adding extra impetus to rental inflation.

Supply of homes for rent unlikely to improve in H2 2023

We do not see a situation where rental supply is likely to expand enough to moderate rental inflation over the rest of 2023. This would have to be driven by an increase in new investment from corporate and private landlords. A sharp slowdown in the sales market could also boost supply. It would mean fewer landlord sales and more owners pushed to renting out homes they are unable to sell.

Higher borrowing costs are hitting the business plans of new investors, slowing the pace of new investment. The impact of higher mortgage rates on the sales market will take a few months to feed through and would require mortgage rates to remain elevated at over 5.5% for much of the summer. This would deliver some support for rental supply in H2, but not enough to close the gap to pre-pandemic levels.

Talk of landlord exodus overdone but some are selling

We do not expect to see a worsening in supply and talk of an exodus of landlords is being somewhat overdone. Our sales data continues to show a steady, constant flow of private landlords selling up –this has been the case since 2018 but its not accelerating. At the same time, there remains continued new investment in rented homes, mainly from corporate and institutional landlords. The net result is no change in the number of private rented homes since 2016.

1 in 10 homes for sale on Zoopla formerly rented out

Over 1 in 10 (11%) homes for sale on Zoopla are former lettings. This percentage has been broadly consistent for the last 3 years as a proportion of private landlords rationalise their portfolios or exit the market in the face of tax changes and higher borrowing costs.

We find that, pre pandemic, half of these homes for sale returned to the rental market as unsold or bought by an investor. This limits the loss of rented homes from the private rented sector. More recently, the proportion returning has dropped to 30%. It means that more homes are lost from the rental market that can be replaced by the flow of new investment.

Higher mortgage rates hit 20-30% of landlords hardest

Higher borrowing costs are hitting landlord finances where they have a mortgage. Using Government data, we estimate that just under two fifths of landlords have no mortgage (38% of those who do have a mortgage, a third have a loan to value (LTV) ratio of less than 50%.

Higher mortgage rates are unwelcome but more manageable for landlords at lower LTVs - there is greater free rental cashflow to absorb higher mortgages rates. It’s the 20-20% of landlords with the highest LTV mortgages that face the greatest squeeze on cashflow. This, in turn, increases the likelihood of a sales as they approach refinancing.

Our data on landlord sales shows a clear concentration in London and the South East, accounting for 51% of landlord sales. These regions have high capital values and low rental yields. This makes the economic situation tougher for landlords in the face of rising mortgage rates, as profits are reduced, especially for higher rate tax payers. The main option for landlords is to inject for equity at a point of refinancing. However, it's an unattractive option for many with concerns over low yields and the risk of further price falls.

Signs of emerging stress for some renters

The rental market provides housing for households on a wide range of incomes. This means higher rents, on top of rising living costs, will hit some renters more than others, especially those on lower incomes.

Recent ONS Opinions and Lifestyle Survey data provides insight into the pressures on private and social renters and their ability to pay higher rents. The chart below compares the answers to three questions on rent rises and ability to meet rental payments and how this has changed from November 2022 to May 2023.

Last November, just over a third of renters have experienced a rent increase in the previous six months. This has now grown to more than half as rents increase more quickly across the market.

Rising rents and living costs mean more renters are finding it “very difficult” to pay the rent, up from 10% to almost 15%. However, just under a half of renters still report that rental payments remain “somewhat” or “very” easy.

The conclusion is that a small, but growing number of renters are falling behind with their rent -a proportion that has doubled in the last six months from 4% to 8%. It seems likely these signs of stress will continue to increase for those on lower incomes. Landlords will need to support renters and manage rising arrears. Higher rents are manageable at his stage for many, but this will vary across markets.

Outlook

With a low likelihood of a major boost in supply, it is affordability and demand side factors that will have the greatest impact on rent inflation. We expect rental inflation to slow towards 8% this year, higher than we expected. We anticipate affordability pressures to start to impact rental inflation in the highest value rental markets over the next 6-12 months. In more affordable areas there is still some headroom for rents to increase further.