Sales rates still high

The lag in housing market data means that key indicators for the UK sales market are not yet fully reflecting the pressure on affordability created by higher inflation and rising interest rates.

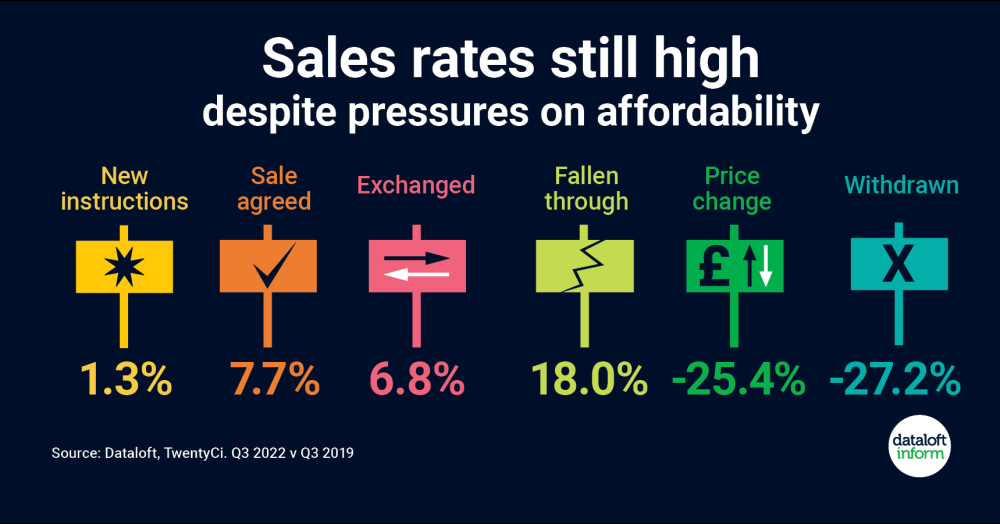

- The number of Sales Agreed and Exchanges in Q3 2022 were both higher than pre-covid (Q319), while the numbers of Price Changes and Withdrawals remain low.

- That said, fall throughs have risen by 18% and they are generally thought to be a signal of market pressure ahead. The 0.75 interest rate rise announced on 3rd November seems likely to dampen activity further.

- As affordability is squeezed, cash or equity-rich buyers will be in a strong position, as long as they can find a property available to buy. Source: Dataloft, TwentyCi