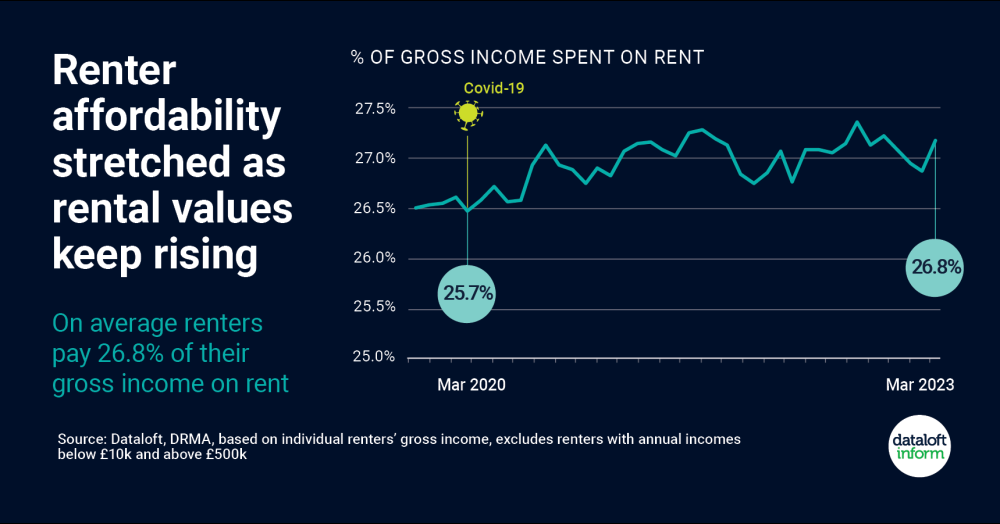

Renter affordability is becoming increasingly stretched as growth in private rental prices continues. On average renters now pay 26.8% of their gross income on rent, compared to 25.7% three years ago.

- Annual rental growth in the UK was 9.8% in the year to March, based on new private tenancies (DRMA). Growth of 4.9% was recorded by the ONS, which includes pre-existing tenancies and new lets.

- Rental price growth is currently stronger than wage growth, at 6.6% in December to February. Wage growth was also lower than inflation, adding additional pressure to household incomes.

- The latest survey of agents by RICS indicates demand for rental properties continues to outpace available supply. However rising affordability ratios are likely to start to limit rental growth.