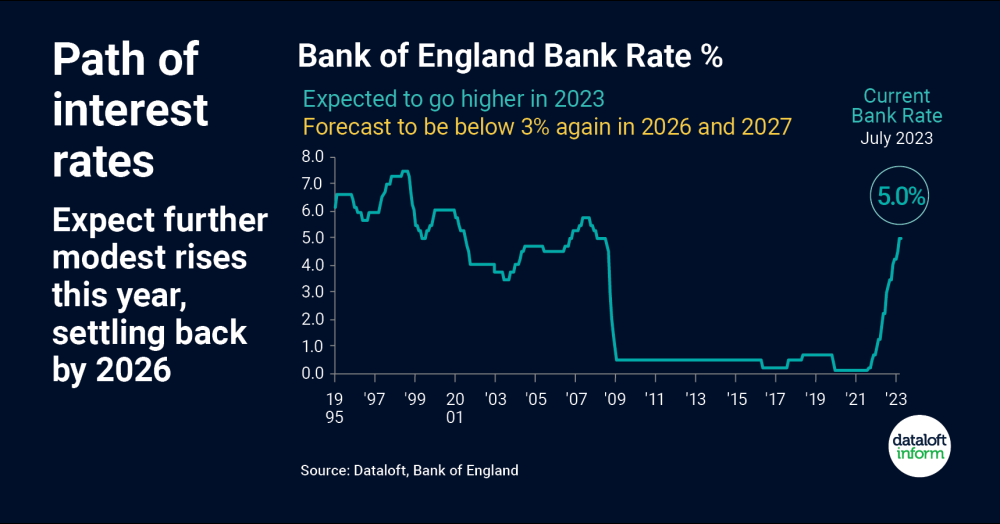

Recent rapid rises in interest rates have left borrowers wondering where this will end. The current Bank Rate is 5%.

- In the short term there are expected to be further interest rate rises. The consensus of forecasts average at 5.6% for the end of this year. Over the longer term the Bank Rate is expected to come down: forecast to be below 3% again in 2026 and 2027.

- The steepness of the increase is comparable with the sharp drop as the economy entered the Global Financial Crisis.

- June inflation data had tentative evidence of improvement which could help improve the long term interest rate outlook. Source: #Dataloft, Bank of England