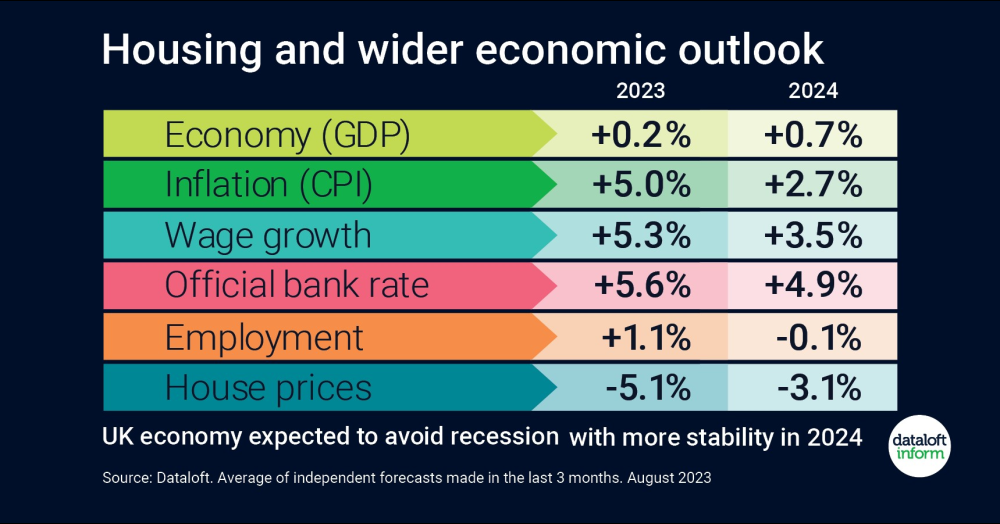

Monitoring the outlook of various economic indicators gives us a good view on both the current and future direction of the UK’s housing market.

- With 14 consecutive interest rate rises, the Bank Base rate reached 5.25% in August. Latest projections are that rates are likely to peak before the end of the year, having successfully begun to curb inflation.

- Inflation is expected to remain ahead of target (2%) while wage growth remains high and employment continues to grow.

- More stability is expected in 2024 with the UK economy now expected to avoid recession. Nationally, house prices falls seem inevitable, but with an election on the horizon, expect some new policy incentives for first time buyers. Source: #Dataloft. Average of independent forecasts made in the last 3 months. August 2023