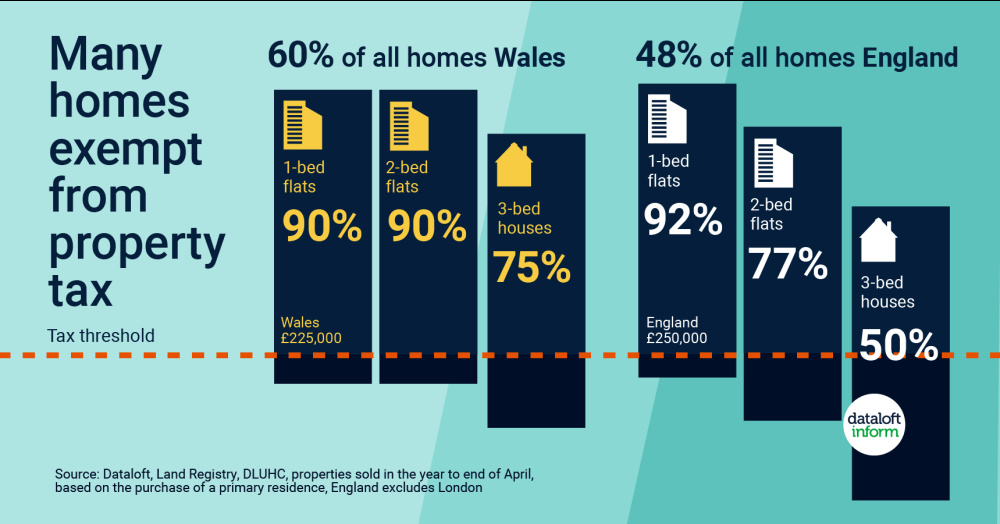

In the past year more than 60% of homes in Wales and nearly half (48%) of homes in England (excluding London) bought by home movers have been exempt from property taxation.

- In Wales more than 90% of all 1-bed and 2-bed apartments sold for below the £225,000 threshold for Land Transaction Tax. In England the proportions sold for below the £250,000 Stamp Duty Land Tax threshold were 92% and 77% respectively.

- Likewise, close to three in every four 3-bed houses in Wales and over half in England sold for below the price thresholds for taxation.

- At £425,000, the threshold for first-time buyers in England (excluding London) is even higher. 80% of all homes sold in the past year have been beneath this threshold: 96% of all apartments and 80% of all terraced homes. Source: Dataloft, Land Registry, DLUHC, properties sold in the year to end of April, based on the purchase of a primary residence, England excludes London