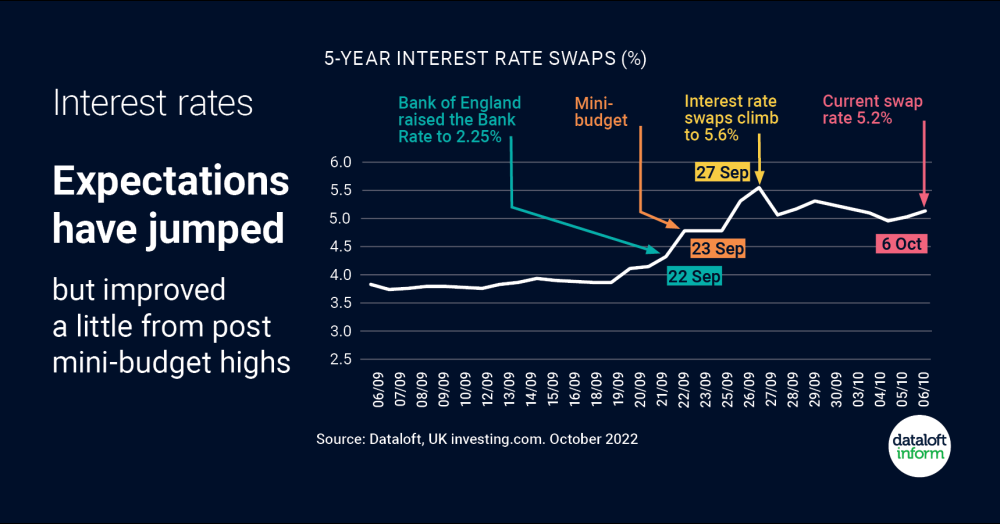

Interest rates expectations have jumped, but improved a little

As widely reported, the Chancellor's mini-budget spooked markets and resulted in the value of the pound sliding and interest rate expectations jumping up.

- Swap rates are often used as an early warning of where mortgage interest rates are heading. Immediately after the mini-budget, 5-year swap rates climbed to a high of 5.6% but have since improved a little to 5.2%.

- The next few weeks leading up to the Bank of England's next meeting and the Chancellor's budget are likely to be volatile for interest rate expectations.

- Interest rates are definitely rising but with current volatility the extent they will need to rise is still unclear. Source: Dataloft, UK investing.com