Interest rates are rising

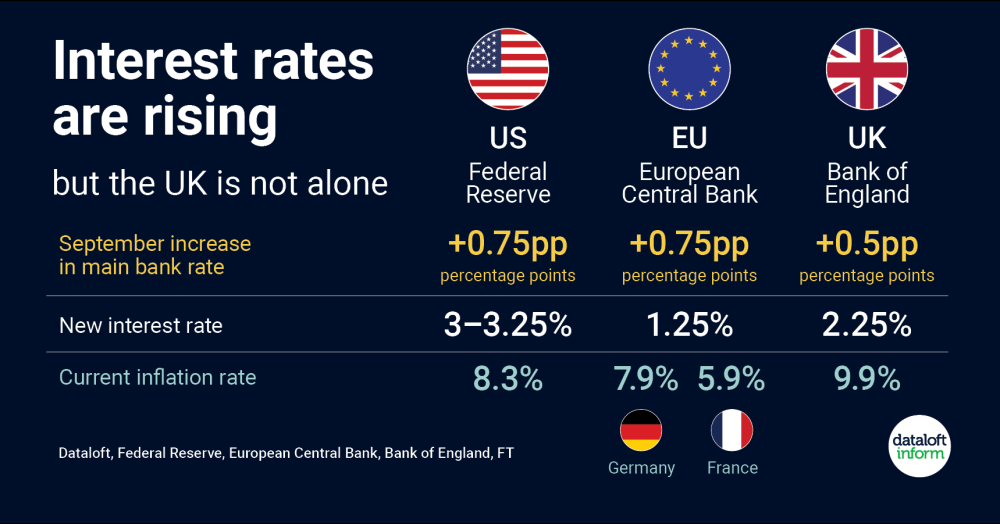

In the September meeting, the Bank of England increased its bank rate to 2.25%. Its seventh consecutive rise and again increasing the rate by a significant amount (+0.5 percentage points).

- Many UK borrowers are protected from any immediate increase by fixed rates (representing 94% of new mortgages*) but borrowing costs are rising for many existing and all new borrowers.

- The Bank of England needed to take decisive action to ensure high inflation doesn’t become entrenched. The UK is certainly not alone in this; the Federal Reserve in the US also increased rates significantly this month, so too the European Central Bank.

- Consensus forecasts, compiled by HM Treasury, suggest that UK inflation could be back to more normal levels for 2023 at 4.5%. Source: Dataloft, Financial Conduct Authority, Q1 2022 data, Federal Reserve, European Central Bank, Bank of England, FT