While we wait for the 2021 census housing data we look to the newly published 2020/21 English Housing Survey data to help us understand the changing relationship we have with our homes since the last census.

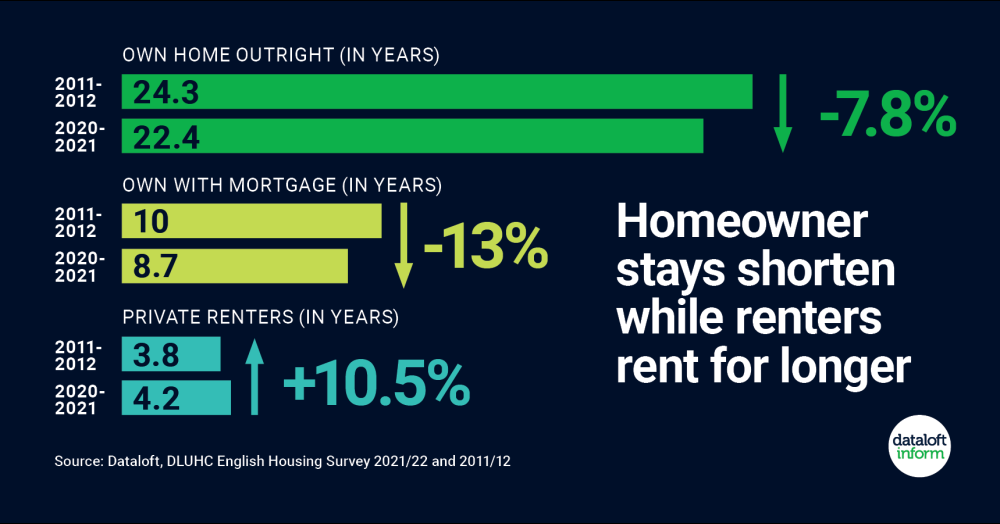

- Since 2011/12, owner occupiers have seen a drop in their length of tenure, from an average of 17.1 years in their accommodation to 16 years in the new 2020/21 survey results.

- In contrast, private renters have increased their tenure length, increasing from an average of 3.8 years in 2011/12 to 4.2 years in 2020/21.

- This slight swing to longer private tenancies comes amidst a new cost-of-living crisis where the English Housing Survey reports 52% of private renters feeling that they are unlikely to be able to afford to buy a home. In 2011/12, this figure was 41%. Source: Dataloft, DLUHC English Housing Survey 2021/22 and 2011/12