Downsizing? How to spend your equity

Over 8.1 million owner occupiers in England and Wales now own their homes outright. This constitutes 52% of owner occupiers, rising to over 90% of those aged 65 or more.

- Based on sales price data from the Land Registry, downsizing from a 4 or more bedroom home to a 2-bedroom apartment could release, on average, over £250,000. The amount varies by region.

- While freeing up under-occupied homes would help ease some of the housing stock issues in the market, downsizers will also reduce their ongoing costs and in many cases would be left with a large pot of equity.

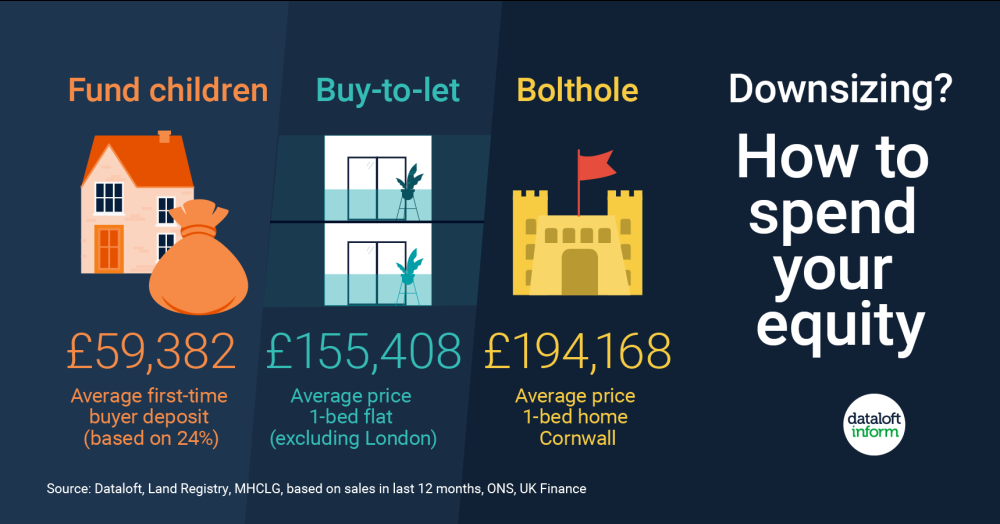

- Such equity could be used to launch children onto the housing ladder, to purchase an investment property or a holiday home, take a holiday of a lifetime or boost the pension pot. Independent financial advice should always be sought. Source: #Dataloft, Land Registry, MHCLG, based on sales in last 12 months, ONS, UK Finance