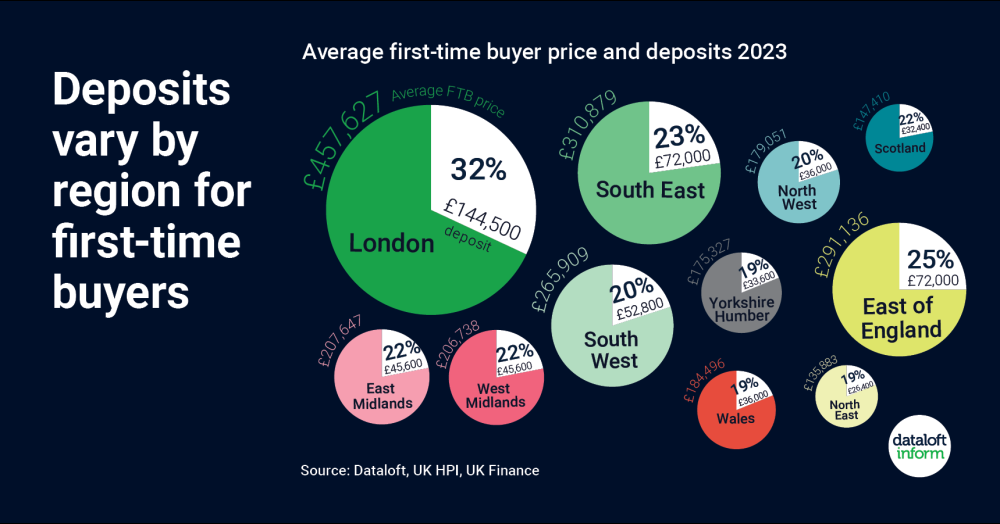

To buy a home in the UK, first-time buyers have an average deposit of between £26,400 and £144,500.

- The average deposit paid by a first-time buyer in the UK is 24% of the purchase price (UK Finance), with many putting down a larger deposit down for their first home.

- Most expensive is London, where the average deposit is £144,500, almost a third of the average sale price.

- Mortgages aimed at first-time buyers, such as the 100% deposit or the shared ownership scheme, can work out cheaper than renting and have helped many onto the property ladder. Source: #Dataloft, UK HPI, UK Finance