The Chancellor pledged to face the economic storm, as he announced widespread spending cuts and tax rises in his Autumn Statement on 17th November 2022, to tackle inflation and escalating mortgage costs.

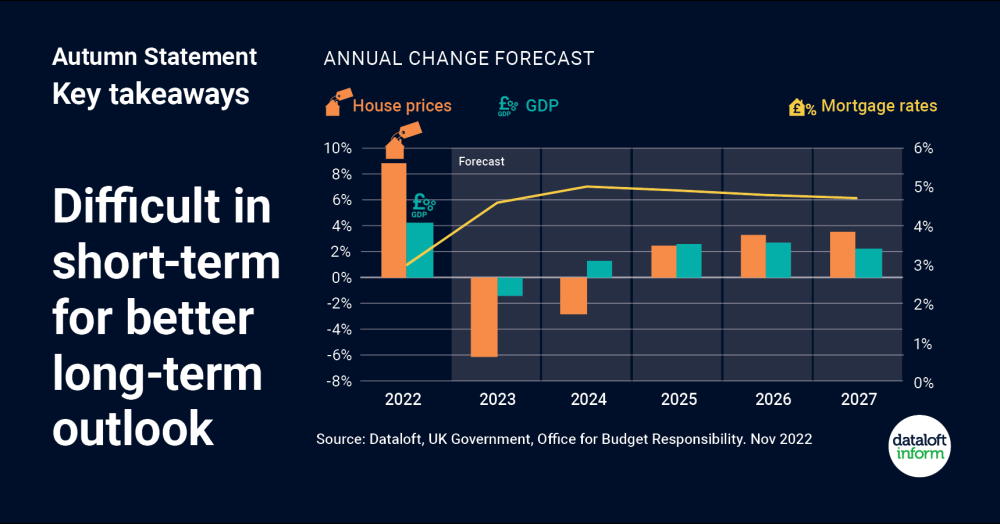

- In the short term GDP is likely to shrink by 1.4% in 2023 but then, due to the new measures being taken, is expected to grow by 9% by the end of 2027.

- The expected 9% increase in house prices this year is likely to be countered by a fall over the course of 2023-24 but price growth is set to resume in 2025.

- Mortgage rates are now expected to peak at 5%. The steps taken have been made to protect long-term economic growth and rebuild the UK economy, which is now officially in recession. Source: Dataloft, UK Government, Office for Budget Responsibility