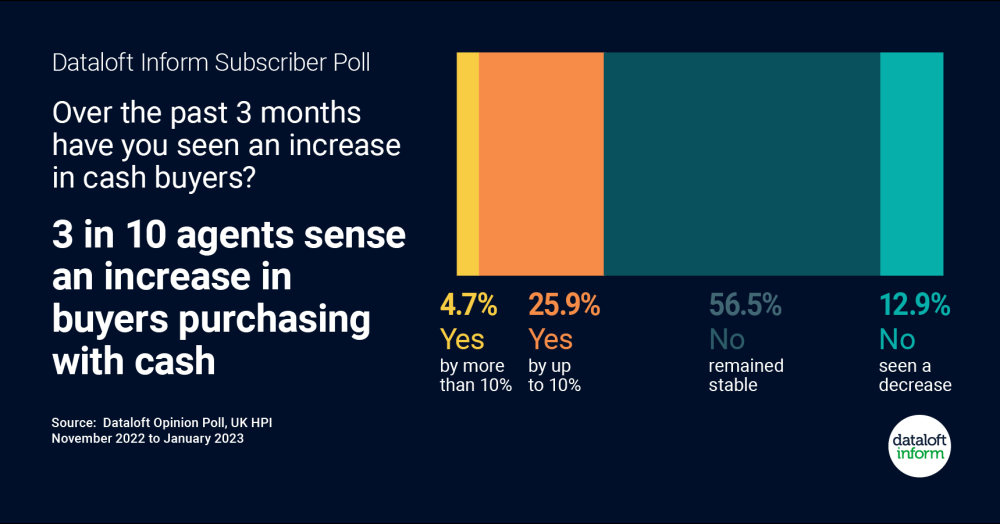

30% of agents sense there has been an increase in cash buyers between November and January, according to the results of the Dataloft Opinion Poll.

- Over half (55%) of agents sense cash buyer numbers have remained stable, while 15% believe they have decreased. This follows the fall-out across the market following the mini-budget and the significant rise in mortgage rates.

- Across England and Wales, 27% of sales recorded in the first nine months of 2022 were cash purchases, in six Local Authorities the proportion was over half.

- Research by Hamptons suggests around 40% of sales in January 2023 were in cash, up from 29% in January 2021 and 2022, suggesting purchasing property with cash may well be on the rise. Source: Dataloft Opinion Poll, UK HPI